Mistake #3 – I didn’t realize that Money management is supreme

I personally think this is the most important part of being a successful trader . The biggest reason for my failure was that – I was very casual about money management and made the biggest mistakes in this area. Money Management in context of trading is all about managing your overall money and how much part of your overall trading capital you put at risk in each trade.

I will give you an example – Let’s say you have set aside Rs 10 lacs for stock market trading . Now let’s say you make 2 rules

Rule 1 : You will never use more than 20% of your capital in any given trade, no matter how promising it looks to you. Which means out of Rs 10 lacs you have , you will not put more than Rs 2 lacs on any single trade (so even in worst case, you will lose only 20% of your capital)Rule 2 : The maximum loss you will allow on any give trade is 10% , which means that if you put Rs 2 lacs on a trade, you will not let the loss cross 10% , which is just Rs 20,000If you see these 2 rules, you can see that the maximum loss in any single trade will not be more than Rs 20,000 which is 2% of your overall capital. So assuming you make 1 trade each month, you have 50 months of quota with you to go wrong fully

No one is so bad that they will make bad decisions every time, you make good and bad both decisions , but important point is that you should survive in markets till that time when you start taking right decisions .. Hence it’s important to be in the game and unless you take money management very seriously , you are bound to get out of the game some or the other day. This is exactly what happened with me. By the time I started realizing that I am moving from “bad trader” to an “average trader” zone , my capital was over and I was already in loss and I never went back to the game itself.

Why one should use Money management ?

The biggest reason why money management should be used is that it does not expose you heavily to the risk on a broader level, even if there is very high risk on individual trades.

And the next big reason why money management is crucial is that it brings some kind of consistency in your growth overtime.

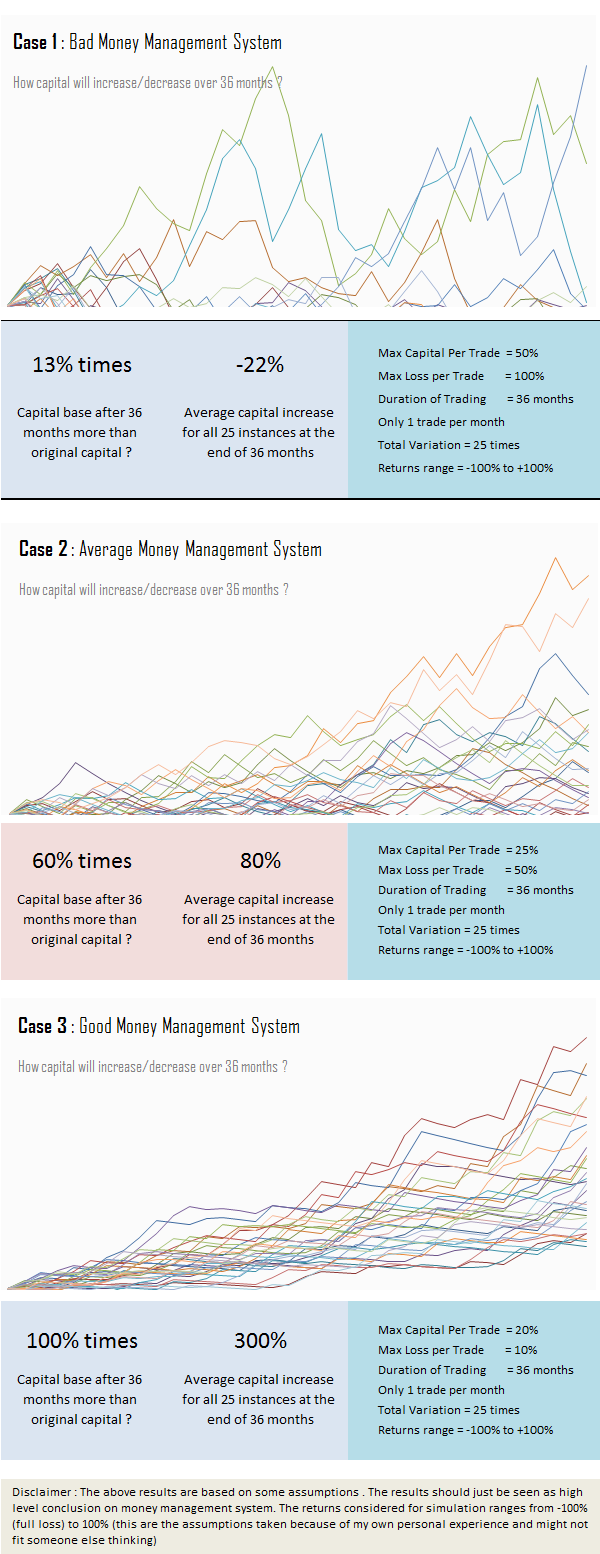

Below you can see 3 versions of money management, which is BAD , Average and GOOD money management, where the overall risk taken on a single trade is moving from high to low.

I did some simulation on excel where we are measuring how capital will grow over 36 months (assuming 1 trade is done in a month) . I ran 25 tests and plotted them on a graph together. You can see how in case of bad money management the growth of capital is very random, unpredictable and varies from very high (lucky) to very low (unlucky)

But in case of good money management , the growth of capital a trader has moves up over time and with high consistency .

So to sum up , I would say money management system is like having a great stamina . If you are there for longer time in markets, in a way you win the battle to some extent.

No comments:

Post a Comment

Leave your comments down below to check for queries