Mistake 4# – I thought trading is all about WINNING

Psychology plays a big role in being a good trader. From the childhood we are programmed to WIN and that same mindset takes over rational thinking in stock markets trading too. We want to WIN on all the trades , It’s hard to accept that you were wrong , being wrong means taking a LOSS . LOSS equals FAILURE and we are never taught properly how to take failures. And that’s exactly what happens in trading, novice traders don’t cut their losses fast, they let them grow (ego) and keep hoping that they will WIN

This is what also happened with me. When I bought an option for a stock, every time I wanted to WIN, every time I wanted to make profit on that option. I thought I will become a great trader , if I WON more and more ..

I was so WRONG

Winning MORE times is not same as making MORE money in stock markets trading. I know some of you who are reading this are confused with this statement , but let me explain this important point

So when it comes to stock market trading, you can’t choose how many times you WIN or LOOSE, but can control HOW MUCH you will win or lose !

All you can do is 3 things

1. You can control how fast you can get out of loosing trade (getting out of a bad decision)

2. You can control how long you will stay with a winning trade

3. And You can control when you will take the decision using your knowledge.

WINNING MORE , but still LOOSING

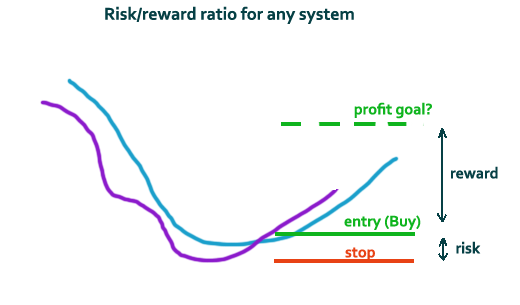

Every trade you make in stock market, you should make sure that your profits potential is generally much higher than the risk potential. Here is how it should look like

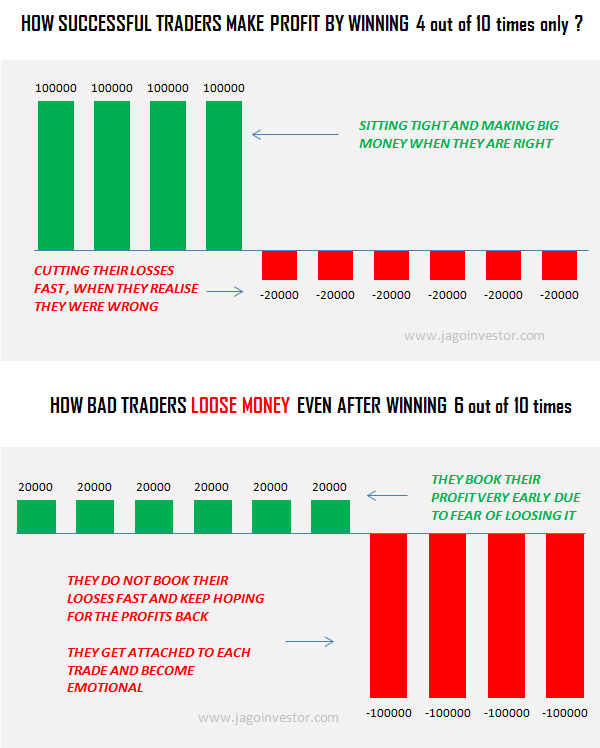

It’s very much possible that a trader wins 6 out of 10 times and still looses the money and in the same manner, it can happen that a trader wins just 4/10 times and still makes a lot of money.

Let me explain this with an example. Let’s say a person has Rs 10 lacs to start his trading .

A good trader wins just 4 times, but he makes sure that he will make big win and every time he makes a bad decision, he cuts the loss fast. And in same way, a bad trader might win 6 times , but every time they are in hurry to book their profits (so they earn small every time) and when they are in loss, they do not book their losses fast (no money management rules in place) and hence let their losses grow because they can’t accept they made mistake (Ego) . The chart below will explain you this .

This is the only big difference between a good trader and bad trader .

Conclusion

Today I have shared my mistakes I did when I traded OPTIONS and I hope you will learn from my mistakes . But this can just be starting point only, you will only learn when you get on the ground and do the real trading. Till then it’s just a practice no matter what you do.

It’s extremely addictive to trade and if you are like me, you will feel a great thrill trading either stocks, futures or options (or any other instruments) , while I didn’t succeed in trading, I at-least know why I failed, I at least came to know my weakness and now I can improve upon it. I can at least help others to not make the same mistakes I did.

Also in future, if I get into trading again, I am sure I will be 10X better compared to earlier version of mine. I know it will still be very though , but I can try at least and when I stopped my trading, somewhere I felt bad about leaving it. I felt as if I am turning my back and got a feel of leaving the battle ground , but it was a right decision because I could have damaged my own net-worth to a big extent had I not stopped.

I would love to hear what you feel about the points I shared and if you would like to share your own experiences

No comments:

Post a Comment

Leave your comments down below to check for queries