Mistake #1 – I focused too much on Knowledge

When I entered into stock markets, I was of the impression that I need to acquire a lot of knowledge on how things work, how various strategies work ? How technical analysis can help in trading ? I learnt all the technical indicators, back tested them on the past data, wrote lot of programming scripts to test my hypothesis. I even went on to download lots of videos online and watched it over and over for many months and I realized that my knowledge had gone up significantly. I now understood lots of concepts, strategies, complex terms .

I could see a chart and instantly see lots of hidden patterns and could tell more than a normal person who does not know how to read a chart.

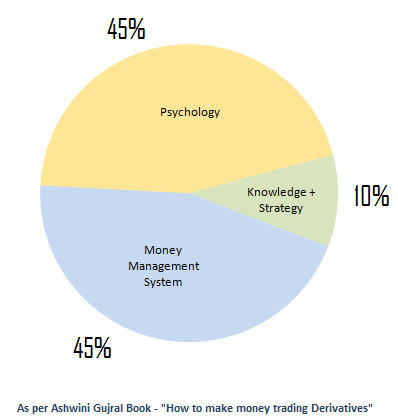

But then, over the months, I realized that “knowledge” is just a secondary element to trade successfully in stock markets. Almost all the good traders around the world agree that “knowledge” does not contribute more than 10-15% in being a successful trader. It’s an important thing , but certainty not the holy grail

I am not saying that one should not focus on “knowledge” part, all I am saying is that it’s not that KEY thing to succeed. Over knowledge will only create problems for you. One of the famous stock trader Ashwani Gujral says in his book – “How to make money trading derivates” – that as per his experience over many decades, he feels that knowledge of charts etc contributes to just 10% of success for any trader. Here is the chart which explains what he mentioned in the book

So, learn things in stock market and then concentrate on the other important elements which you will learn in some time. Dont overthink about knowledge part.

No comments:

Post a Comment

Leave your comments down below to check for queries